In this Landlord Focus article, we ask GetGround questions surrounding owning property in a company structure; the benefits and any drawbacks together with how they assist landlords in structuring ownership.

Landlords might be aware of the potential benefits of owning property in a company structure but have no knowledge of how to move their investment into this set-up or how to establish a limited company for this purpose in advance of buying a rental property.

GetGround specialise in setting up and running limited companies on the behalf of existing and potential landlords for the sole purpose of buying and investing in UK properties.

What are the benefits of owning property in a company structure?

Investing through a limited company, rather than your personal name, has all sorts of benefits. Here’s a quick (though not exhaustive) snapshot:

Tax benefits

A limited company could cut your tax bill. You’ll pay Corporation Tax on 19% of your profits, often up to a limit of £50,000 per year. But if you invested in your own name, you’d pay up to 45%. That’s a considerable difference.

Plus, you can deduct mortgage interest payments from your tax liability with a limited company. You can no longer do this in your own name.

Estate planning benefits

When you invest through a company, you make the whole estate planning process much smoother. You can easily gift shares in your company to your beneficiaries, and – provided you do this more than seven years before you pass away – you can cut any inheritance tax bill considerably.

And, with shares, you have the flexibility to transfer as much of a stake as you like, whenever you like, while still retaining control of your investment as a director. There’s very little flexibility to estate management if you invest in your own name.

Investing as a group

A limited company guarantees transparent ownership when you invest as a group. If you buy a property with friends or family in your own names, everyone owns it together – there are no set shares. Even if one person put in 80% of the capital.

This can cause disputes when it comes to dividing profits. But, with a limited company, it’s all very clear – you can split the income based on the proportion of shares people own in the company. So you can invest together without any tension.

How can owning a property via a limited company lower personal risk?

By keeping properties in their own limited companies, you can secure the rest of your portfolio should anything go wrong – such as a mortgage default. Without a limited company, there’s a risk that any problem with one property could affect your whole portfolio. In that sense, a limited company can safeguard each investment, mitigating personal risk.

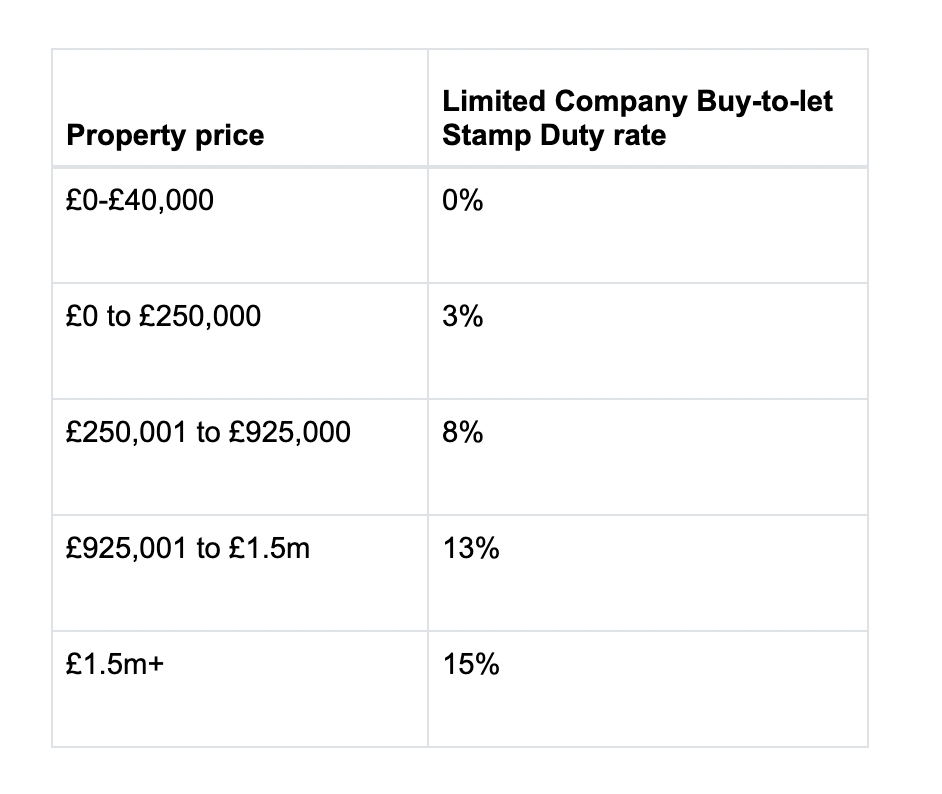

Stamp Duty Land Tax (SDLT) when buying through a limited company

Limited companies are always liable to pay the 3% SDLT surcharge, regardless of whether it’s the first property that company has bought or not. Otherwise, a limited company will need to pay the same SDLT as any other investor planning to buy an additional property.

See the rates below (accurate Feb 2023):

Are there any pitfalls to owning property in a company structure?

Other than the SDLT surcharge – which most investors will pay regardless – there are two common sticking points:

Mortgage rates

Mortgage rates are generally higher for limited companies than for individuals. That said, they’re rarely much higher, and – with all the tax benefits a limited company can afford – it’s still often more profitable to invest with a limited company. The key is to avoid seeing costs in isolation but to weigh up the costs and benefits in their entirety.

Admin & accounting

The second pitfall is often the cost and hassle of administering a limited company. As a director of a company, you’re responsible for filing accurate accounting documents, end-of-year tax returns, etc. You can choose to leave this to an accountant, of course, but this can get quite expensive, meaning lower profits.

How would you get started? And where does GetGround come in?

We’re biased, of course – but GetGround lets investors easily access all the benefits of a limited company without all the admin and end-of-year tax panic. So we’d probably recommend starting there!

When you incorporate your limited company with GetGround, you can design it in just half an hour in a guided online experience. And then, once it’s up and running, leave all the admin (like accounting, tax returns, and even post-management) to us.

This means you get all the upside of a limited company, without the hassle – or the cost. GetGround’s monthly subscription is just £19pcm + VAT. So you can forget sending half your profits to your accountant and enjoy more of the profits yourself.

Wondering whether a limited company is right for you and your UK property investment?

Explore the possibilities of owning property in a company structure: Book a free, no-obligation consultation with GetGround.

Investing in property in London

If you’re seeking an investment property in London, our local knowledgeable team of agents would be delighted to assist with your search for the perfect property to rent out to tenants.

Contact Horton and Garton to register your interest in investment property for sale.