WINTER 2023

ISSUE 9

Horton and Garton Estate Agents

Welcome to Horton and Garton’s latest West London Property News – Winter 2023.

2023 has been a pivotal year for the UK property market, particularly in West London, with surprising resilience against economic forecasts. The market is poised to conclude the year stronger than previously anticipated, beyond the desirability and enduring appeal of the area, other external variables, such as the consecutive reductions in mortgage rates of late, have somewhat allayed common market concerns many experienced earlier in the year.

SALES

A Tale of Three Postcodes

Whilst the borders of W6, W4 and W12 are all immediate neighbours, each postcode area has experienced differing levels of activity throughout 2023, and Chiswick has experienced a far more active end to 2023 when compared to Hammersmith and Shepherd’s Bush. With sales being agreed and transactions taking place right up to the final curtain call in W4, where activity across other parts of West London has tapered off.

The national market reports supply of properties for sale is at a six-year high, but this is not reflected here in West London, sales volume is hovering at around a third of the normal levels, even the levels in the typically quieter months. It is evident prices have softened, and several potential sellers have simply decided to stall their plans and wait to see what happens in the new year. Is this the right decision? Personal financial positions are a key driving factor but for those who can move should they wait or seek to sell and find a new home?

In the throes of price adjustment, those planning to move house are wise to focus on the longevity of a purchase and less on whether it is the most opportune time; no one has a crystal ball. If the financials work, now is as good a time as any to move, particularly since prices are unlikely to remain ‘soft’ for too much longer.

John Horton, Owner and Director

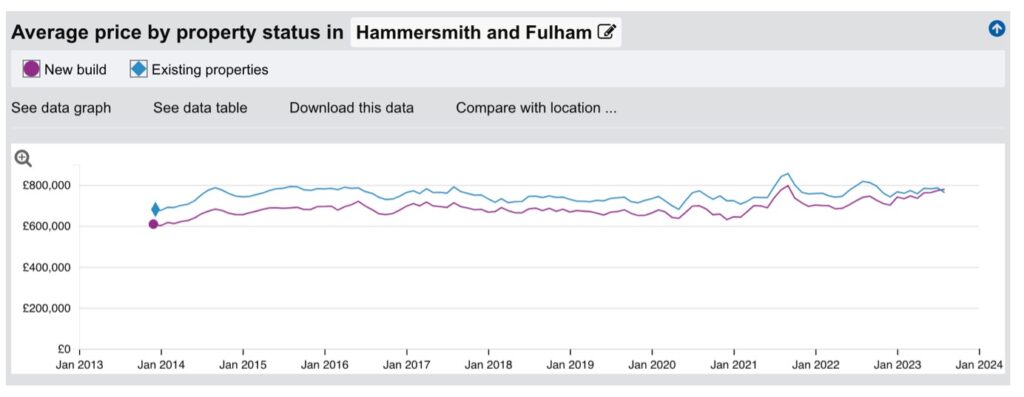

Whilst you should of course have one eye on the existing market, in 7, 10 or even 15 years the landscape will be wildly different to today, meaning those making longer-term moves are typically less affected by market conditions. Across the borough of Hammersmith and Fulham in December 2013 the average property price according to Land Registry was £675,294 – 10 years later the average property price is £761,737.

Taking Decisive Action

Buoyed by a significant saving on stamp duty which will remain in place until 2025, first-time buyers are some of the most active in the market. Often supported by family in the form of a sizeable deposit, many first-time buyers in the area have been less affected by high mortgage rates. Similarly, downsizers continue to be prevalent, usually buying a smaller property funded entirely by cash.

Those who are not in such a strong position financially may have had to assess whether or not they can currently afford to move and seemingly at certain price points and for particular property types there has been a noticeable reduction in activity. The ‘second steppers’, those typically moving from their first-time purchase to a more long term home, are more likely to find a move challenging if they have bought within the last few years and are due to reach the end of their mortgage product – with less capital growth in this time funding a move to a larger property may not be practicalThere is evidence pointing to many sellers opting to wait for rates to bottom out, believing that values will recover when they do.

Those who intend to sell in 2024 might wish to take action earlier in the year to avoid being another property that may potentially get caught up in a stampede that will be triggered should interest rates reduce as predicted.

Louise Jones, Chiswick Sales Manager

While buyers have been negotiating discounts, the easing cost-of-living crisis and falling inflation, along with improving mortgage rates, have reduced the extent of the discount vendors are willing to accept, or in many cases, are able to accept. In some instances, vendors may genuinely be unable to accept a lower offer if it does not facilitate the financial requirements to fulfil their onward plans.

If your plans to move hinge on finance, shop around for mortgages, talk to several mortgage brokers as they each have different relationships with lenders – some brokers are able to obtain better rates than another because of this. Mortgage rates are gradually becoming more attractive, indicating a more positive outlook for the year ahead, though other matters will be at play.

Outlook for 2024

Looking towards 2024, the market’s trajectory is dependent on several factors. The Autumn Statement made no significant announcements impacting the property market, but the upcoming election could introduce housing market policies that may have an impact on the appetite to move. Interest rates, having stabilised since August, are expected to support more affordable mortgages, influencing activity positively.

Tailored advice will be crucial for making informed decisions when moving house. As local West London estate agents, we are here to provide expert guidance and support for your property needs.

LETTINGS

All evidence indicates that the London lettings market reached its peak towards the end of 2023, and values are not expected to rise further. Welcome news for tenants and offering greater clarity for landlords who may have been uncertain as to whether to stick or twist in the previously dizzying market.

Aggie Tukendorf, Lettings Manager

An Adjusting Market

The London lettings market continues to find its new normal, landlords listing their properties as recently as three months ago would already experience a reduction in value in today’s market.

This adjustment in pricing is a natural and perhaps overdue correction to inflated prices driven by heightened demand – long-term tenants can simply not afford the prices that were being reached.

Stock levels are now higher and the rental market overall feels more stable, a welcome setting for all parties seeking to make longer term plans.

We predict there will be a flurry of activity as we return after the festive break and potential tenants seek to find a new place to live.

Changes to legislation

Over the course of 2023 there have been several decisions made on proposed changes to legislation that will directly impact landlords.

There have been several changes to taxation that might be applicable such as the annual tax-free allowance for Capital Gains Tax having reduced to £6,000, with a further decrease to £3,000 due in April 2024. For those who hold their properties in a company structure, corporation tax rates for profitable companies increased from 19% to 25%.

Additionally, the government scrapped the proposed stringent EPC regulation upgrades, maintaining the minimum requirement of an ‘E’ rating for rental properties. This decision, influenced by the financial implications and the cost of living crisis, provides some relief for landlords; you can read more about EPC requirements for landlords in our blog article.

The UK government also put a pause on the proposed abolition of Section 21, which allows landlords to end a tenancy without a reason after a fixed-term tenancy ends or during a tenancy with no fixed end date.

As local West London estate agents, we remain committed to providing expert insights and guidance, helping clients navigate the evolving property landscape with confidence.